What is the Bid and Ask Spread? – The bid-ask spread is the variance between the bid price and the asking price for a given safety. The bid price signifies the maximum price a buyer is eager to pay for the safety. While the asking price signifies the lowermost price a seller is eager to receive.

In the stock market, a purchaser will pay the asking price, and a seller will accept the bid price because that’s where supply encounters demand. The bid-ask spread is a kind of deal cost that drives into the pocket of the market creator. An intermediater who retains the market arranged.

Whereas it may seem irrelevant or easy to supervise. The bid-ask spread is a real cost to depositors, and in risky cases it may amount to a non-trivial ratio of the trade’s value. Due to this, active traders in specific may want to pay care to the bid-ask spread.

Table of Contents

How to Analyze the Bid-Ask Spread?

Bid and ask is a significant idea that many retail depositors supervise while transacting. It is vital to note that the current stock value is the value of the previous trade – an old price. The bid and ask are the values that buyers and sellers are eager to trade. In essence, bid signifies the demand while ask represents the safety supply.

For instance, if the present stock quote comprises a bid of $14 and an ask of $14.20, a depositor looking to purchase the stock might pay $14.20. A depositor looking to sell the store would sell it at $14.

For instance, if a stock value has a bid value of $100 and an ask value of $100.05. The bid-ask spread might be $0.05. The spread can also be stated as a ratio of the ask price, which in this case might be 0.05 ratio.

What a Bid-Ask Spread Expresses You?

You may not have spent a great time thinking about the bid-ask spread in stocks. But it can have little informational worth. Here’s what it means in different market circumstances.

Extensive Marketplaces

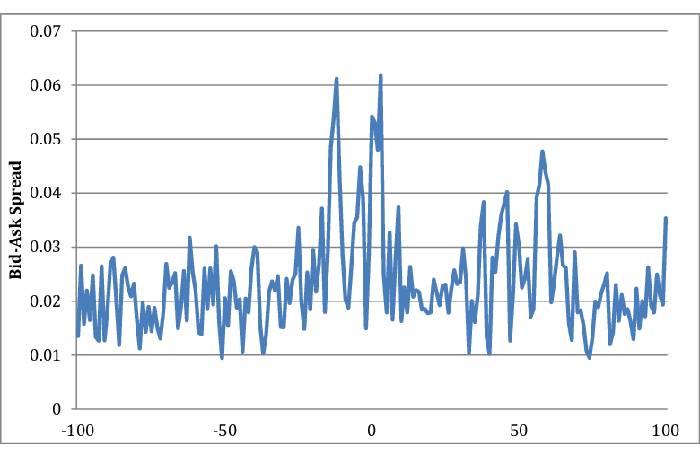

Marketplaces with an extensive bid-ask spread are classically less liquid than markets with a slight stretch. The reach broadens because there aren’t high heights of supply and demand or purchase and vend guidelines to match up effortlessly. The advanced deal cost, in the form of a developed spread, is compensation to the market maker for the illiquidity.

Tinny Marketplaces

Conversely, markets with a thin or narrow bid-ask spread are typically highly liquid. They have plentiful buy and sell orders from traders. Widely traded stocks, such as Apple, Microsoft and Amazon, have narrow spreads. As there is a high amount of supply and demand for their shares. It’s very easy for market makers to find a buyer or a seller in the stocks of these types of blue-chip companies. Small-cap stocks or more obscure companies may have wider spreads due to the lack of investor interest.

How does a Bid-Ask Spread Relate to Liquidity?

Differences between bid-ask spreads from one security to the next, or even between asset classes, is because of the differences in liquidity between the assets. Within the stock market, you’ll typically see a wider bid-ask spread for small- or micro-cap stocks than you would for widely-followed large-cap stocks that are very liquid.

As you move from the stock market to the bond market, liquidity may fall. Despite the bond market being larger in overall size, causing bid-ask spreads to widen.

You might also see wider spreads in securities with high volatility, because the market maker wants additional spread to compensate them for the risk that prices change.

Most traders and professional investors use limit orders when placing trades. Allowing them to choose the price they’re willing to buy or sell at, rather than placing a market order that is subject to the pricing at the time of the trade.

Conclusion

The bid-ask spread is a close look when purchasing or vending security, mainly if it’s an investment with low liquidity. Some properties, such as large-cap stocks may have so much supply and demand that the spread is hardly visible. In contrast, other securities such as micro-cap stocks or particular bonds may have spreads that make up a visual ratio of the asset’s price.